Introduction to Rich Dad Poor Dad

Robert Kiyosaki’s book “Rich Dad Poor Dad” questions preconceived ideas about money and financial literacy.

His biological father, the “Poor Dad”, who pursued standard educational and professional pathways, and his best friend’s father, the “Rich Dad“, who had a different attitude and approach to money, are presented in stark contrast.

The most popular statement of the book “Rich Dad Poor Dad”, states “the rich don’t work for money”.

Every person living on this planet has an inbound need to earn money. But what sets people apart from financial independence is the ability of them to look at money differently.

This blog post will help to:

- Showcase the unusual insight underlying the proverb “savers are losers”.

- Discover alternate methods for building money and achieving financial independence, as well as understand why conventional saving methods may impede financial growth.

- Learn how to make your money work for you and adopt a perspective that promotes long-term success.

Also Read: Things You Need To Know About Investment And Speculation

Money Explained

As per the author, money should only be looked at a medium for exchange of value. You need money to meet the everyday needs of your life.

But, is money everything?

You can’t create wealth by saving money over a long time. Every person should realise this early in life that, to generate life long wealth, one must own Assets.

Additionally, money serves as a store of value, enabling people to save and build wealth through time. It helps people delay consumption and allocate resources for later use, maintaining their purchasing power.

People can preserve their economic value and have the freedom to spend it as needed by retaining money.

But, will saving up money make you rich?

Assets vs Liabilities

Rich Dad Poor Dad, strongly reflects on creating and acquiring assets rather than liabilities. As per the context of the book, assets are instruments that produce income and liabilities that deplete financial resources.

For example, if you own a laptop and edit videos from it, it is an asset. The reason being, you can now sell video editing as a freelancing service to further make money, Thus, in this case, your laptop could be your asset.

The best example for a liability could be your car. In order to own a car, one needs to regularly put money for its fuel, maintenance and insurance. Thereby, removing money from your pockets.

Why Savers Are Losers

The primary reason why saving money will not make you rich is Inflation.

The value of money tends to decline over time due to inflation, which erodes purchasing power.

The purchasing power of saved money may decrease if the rate of inflation outpaces the interest earned on those funds.

This means that keeping big sums of money on hand is less profitable because the same amount of money saved now might not have the same worth tomorrow.

Money in the Making

Having a state of financial independence is very important. The author understood this very early in life.

A state of financial indigence being, making more money (mostly passively) than you actually spend. Having passive income helps you live a life without thinking about making money over a long time.

There are two scenarios how you can make money:

- Taking a job, freelancing, commissions

- Starting your own business / company

There is nothing wrong to make money while you are at a job. In the book, it is explained in depth why you should not work for money, and having to work for a job somewhere puts you in a mentality that you are working for it.

The best way to look at a job is by looking at it as a means to get experience from the industry experts from your domain, build connections and grow your network.

On the other hand, having a business helps your scale your income exponentially. While, you can draw salary from your business account, you can also enjoy the profits made and re invest it into assets.

Cash Flow vs Capital Gains

The money that come to you majorly gained in the form of two ways, cashflow and capital gains. Having a good cashflow helps you meet your short term needs, While, capital gains helps you accumulate wealth over a longer period.

Understanding Cashflow

Cashflow is defined as the movement of money in and out of a business.

Let’s consider for an individual, cash flow will be the amount of money that will enter and exit from your bank account.

It is obvious to state that, in order for you to be financially independent, you need to have more money coming into your bank account, than the expenses. If you are having more money entering your bank you are considered as cashflow positive.

Types of cashflow:

- Cashflow from operations

- Cashflow from Investments

- Cashflow from selling assets and scraps.

- Cashflow from operations is the money you make as per actuals. Be it your monthly salary, money from freelancing, commissions or salary drawn from your business.

- Cashflow from investments are your dividend income, interest gained from bonds and fixed deposits etc.

- Cashflow from selling assets / scraps is the money you will make from selling your old assets, like a used car, old machinery etc.

For any individual, keeping the cashflow positive is extremely crucial. Having a job, limits your incoming cashflow from your operations.

At the end of the day, you will make the same salary, regardless of your efforts at your job. Thus, your cashflow is restrained.

Therefore, the best way for increasing your cashflow is by investing. Investing for returns from dividends and interest gained from bonds, fixed deposits etc can help individuals gain higher income .

Capital Gains

When a person sells an asset for more than it was originally purchased for, they are said to have realised a capital gain.

It is the difference between the asset’s selling price and its adjusted cost base, which includes both the initial purchase price and any acquisition-related costs, including commissions and fees.

Investing in a variety of assets, such as stocks, bonds, real estate, enterprises, and priceless personal belongings, may result in capital gains.

You might also like: 5 Top One-Time Investing Strategies For Best Results

Make Money Work for You

The best way to make money work for you is investing. Investing itself is a broad topic and one needs to analyse which investing instruments fits right.

Diversifying your sources of income is one of the fundamental concepts of making money work for you. Your ability to build money is limited if you rely entirely on one employment or income stream.

This can be done in a number of ways, including buying stocks, investing in real estate, or beginning a side business. Having several sources of income allows you to build wealth more quickly and assures that you are not completely dependent on one source.

Conclusion

“Rich Dad Poor Dad” is a thought-provoking book that upends preconceived notions about money and financial security.

It offers readers insightful information on the significance of financial literacy, mentality shifts, and wise investing decisions.

Even though it might not completely cover all facets of personal finance, it’s a great place to start for anyone looking to expand their financial horizons and work towards financial independence.

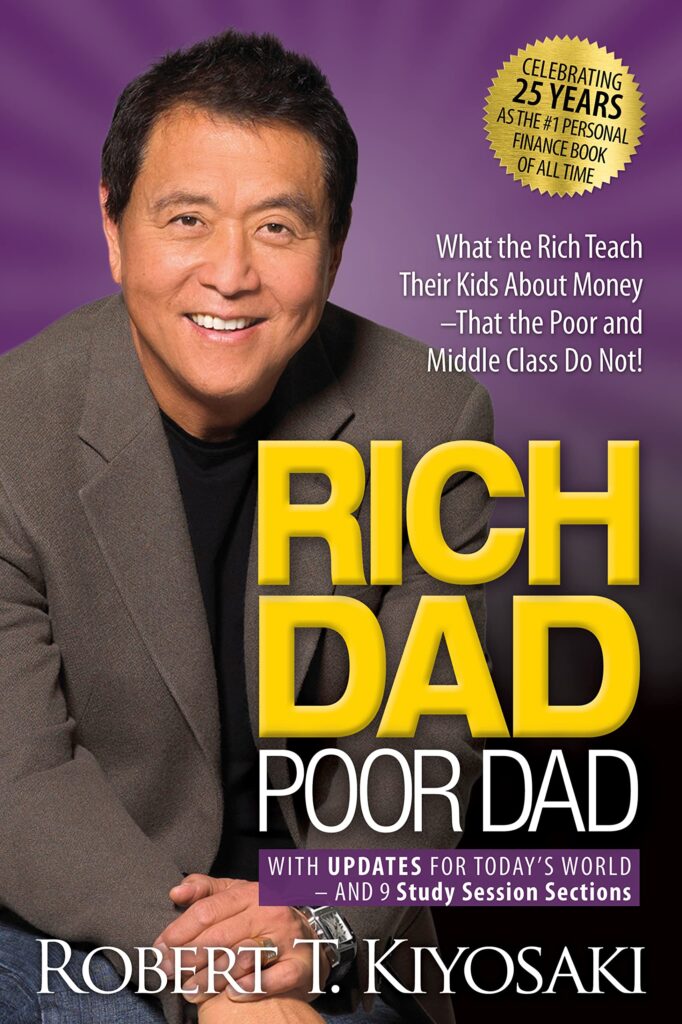

Rich Dad Poor Dad: 25th Anniversary Edit

Check it out on Amazon!