Introduction

Long Legged Doji and Dragonfly Doji are two fundamental type of Doji Candlestick Pattern. Before we dive deep down into the technicals of these candlestick patter, let’s understand what is a Doji.

A Doji is a Candlestick Pattern in a trading chart which indicates that the opening price and the closing price is the same.

A formation of Doji Candlestick Pattern is very crucial for traders as it signifies a change in trend.

Also read by blog on How To Read Different Types Of Doji Candlestick Pattern to get a better idea on the fundamentals of a Doji.

When the opening price and closing price of a stock is the same, there is no formation of a candlestick body. Thus, the image of the Doji would look like one presented below.

Let us have a quick introduction to Long Legged Doji and Dragonfly Doji.

What is a Long Legged Doji

A Long Legged Doji is a neutral candlestick pattern that represents market indecision in the movement of a stock price.

A small genuine body (candlestick) in the centre and extended upper and lower wicks (shadows) of a candlestick set the Long Legged Doji apart.

Long wicks show that there was a lot of price movement during a short interval of time, as both buyers and sellers drove the price upward and downward.

A Long Legged Doji indicates a shift in the direction of supply and demand equilibrium when it emerges during strong uptrends or downtrends.

The exceptionally lengthy wicks of a Long Legged Doji candle indicate the presence of two equally powerful yet opposing energies. Thus, this candlestick conveys a lack of resolve in the market.

What is a Dragonfly Doji

A Dragonfly Doji, on the other hand is a Doji Candlestick Pattern that has a tail wick longer than that of its head, resulting in a formation of a T-shaped candlestick.

The prolonged lower wicks of the candle is one of the most important feature of this pattern.

A Dragonfly Doji is a type of candlestick pattern that may suggest an upcoming price reversal to the upside or downwards, based on its prior candlestick formation.

You might also like: Unveiling The Secrets Of The Doji Candlestick Pattern

Difference between Long Legged Doji and Dragonfly Doji

While there could be a few other types of Doji Candlestick formation, we will restrict our study in understanding the major differences between a Long Legged Doji and Dragonfly Doji.

Formation of wicks

Long legged Doji is formed in most volatile markets where the buyers and sellers are confused of the price point at which the stock is trading.

The volatility dives the prices aggressively over a short duration, which finally closes the stock at its opening price.

On the other hand, a Dragonfly Doji is formed when there is a chaos and the buyers believe that that the price needs to be higher. It is a point where the last seller has realised that the price would be pushed higher and now turns into a buyer.

A formation of Dragonfly Doji after a downtrend states that, the sellers have closed their positions and now turned into bulls to drive up the market.

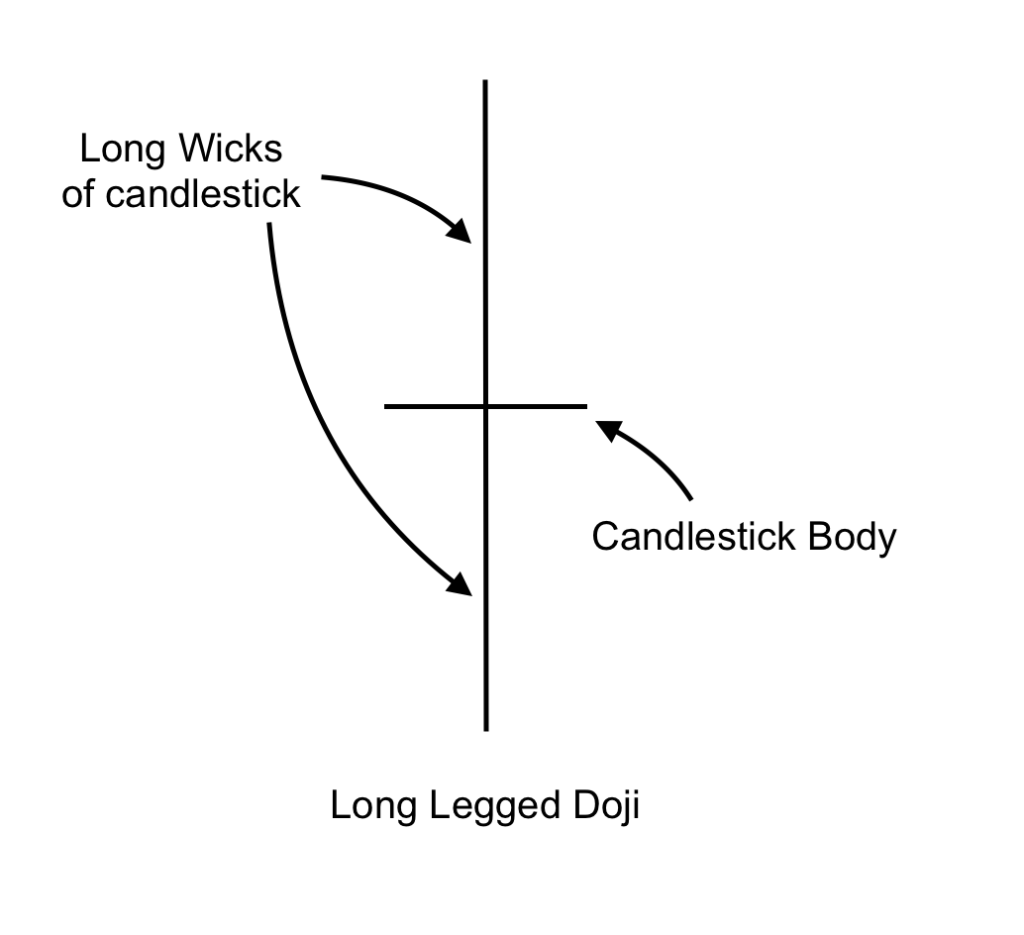

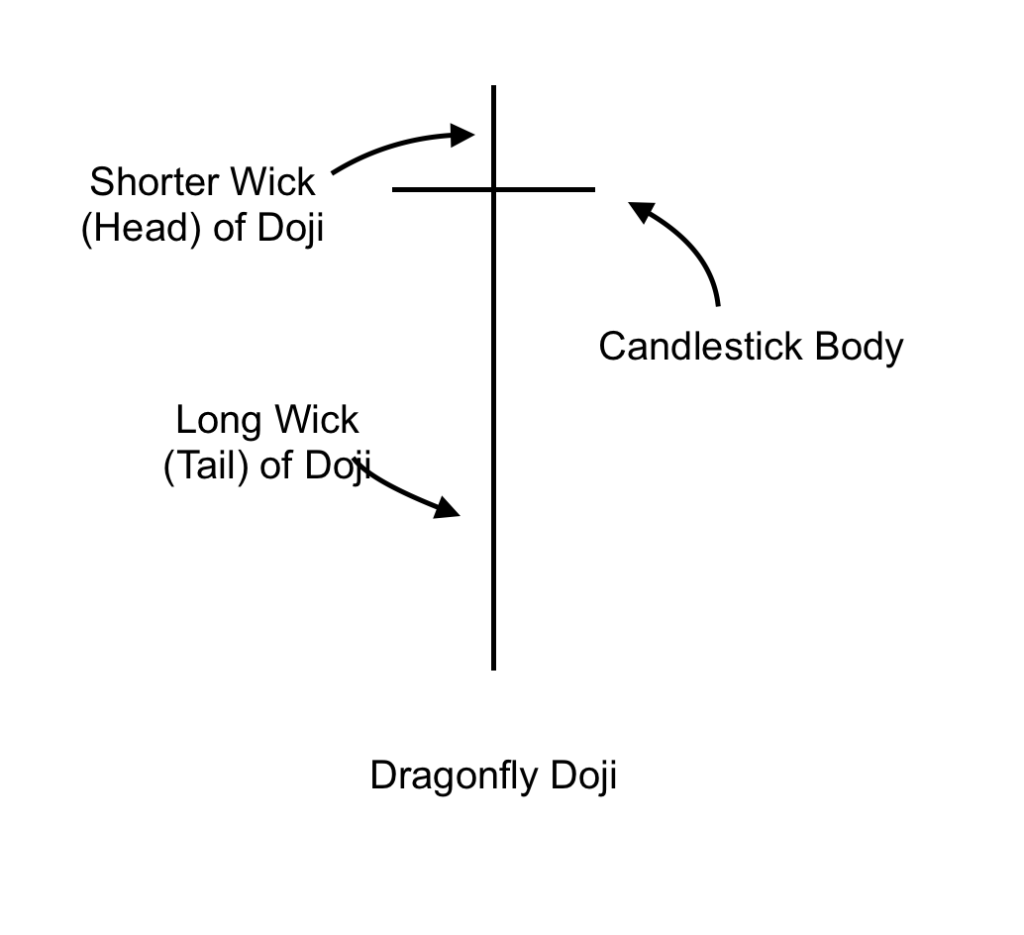

Visual representation of Long Legged Doji and Dragonfly Doji

The below figures depict the formation of Long Legged Doji and Dragonfly Doji.

Key Points to Long Legged Doji

- Long legged Doji has a long wicks at the both the ends of a Doji pattern.

- These long wicks indicate that there is equal buying and selling pressure from the traders.

- This is a point of pivot, as the traders are not sure whether to hold their positions any longer.

- In case of a downtrend and formation of Long Legged Doji, the sellers will turn into buyers and drive the markets. The vice versa is also true.

Key points to Dragonfly Doji

- Dragonfly Doji has a long tail wick (shadow) and a shorter head.

- The Doji has a T-Shape formation.

- A formation of Dragonfly Doji usually signals a uptrend in the charts.

- This candlestick signals trend reversal from downtrend to uptrend.

Psychology of traders

When the traders see the Long Legged Doji, the traders are of the opinion that there is a tough fight between the buyers and seller to drive the market, yet not sure of their position. The team with the stronger opinion will further drive the market.

While, the Dragonfly Doji indicates that, although the sellers had forced the price down, the buyer quickly entered the market the took the prices upward. This formation could indicate a price increase, as it shows greater buying pressure during a decline.

Setting new trends

The formation of Long Legged Doji puts a signal to the traders that there is a point of indecision between the buyers and sellers.

The buyers and seller are not confident about the bet at this formation. Thus, the price fluctuates very violently, but the opening and closing remains the same.

On the other hand, a formation of a Dragonfly Doji is a clear indication that the last seller has now turned into a buyer in the market. Although the Dragonfly Doji pattern is rare, when it appears, it serves as a signal that the trend might be about to be changed.

Conclusion

The main difference between a Long Legged Doji and Dragonfly Doji is the formation of its wicks (shadows). A Long Legged Doji has long wicks on both side of a Doji Candlestick, while a Dragonfly Doji has a longer tail wick (shadow) than its head.

Please note that, technical analysis may help you forecast the price of a stock, only up to an extent. It is definitely not a for sure method to identify and predict market trends. One must understand that, there are several other factors, other than technical analysis that determine the price of a stock.

The only way for a professional trader to play long is risk management. A good trader needs to cut his losses short when the trend goes against his prediction.

Trade responsibly!

Also Read: The Best Doji Candlestick Trading Strategy For Beginners